Beginner’s Guide to Halal Investing in the US (With Zakat & Purification Tips)

Halal Investing in the US: 2025 Overview

Halal investing in the US is gaining traction as more Muslims seek ways to grow their money ethically. Navigating the financial world here can be tough, though. Many investment options involve interest, high debt, or industries that clearly violate Islamic principles.

You might wonder: Is it even possible to invest without compromising your values?

Thankfully, yes—and it’s easier now than ever before. Today’s Muslim investors can access a growing range of Shariah-compliant stocks, mutual funds, ETFs, robo-advisors, and screening tools. With the right knowledge and platforms, building a halal investment portfolio in the US is completely within reach.

This comprehensive guide explains what halal investing is, outlines your investment options, shows how to screen stocks and funds, and walks through zakat and purification—all tailored for Muslims in the US.

Why Choose Halal Investing in the US

Let’s face it. Investing in America can feel like walking through a minefield for Muslims. Interest is everywhere. Most companies are tied to things we try to avoid like alcohol, gambling, or conventional banks. So why even bother?

Because believe it or not, you don’t have to settle.

Halal investing isn’t just about avoiding what’s haram. It’s about building a future ethically and responsibly. And these days, that’s actually doable. Thanks to new fintech tools and a growing Muslim demand, halal investment platforms are more accessible than ever.

You can now invest in US-based stocks, mutual funds, and even real estate all without touching interest or shady industries. Whether you’re saving for your children’s education or just trying to grow your money the right way, halal investing gives you a way to stay true to your values while participating in the market.

And yes, halal investing is fully legal in the US. You’re not doing anything wrong by asking for more from your money. You’re doing what Islam has always encouraged—acting with intention and responsibility.

Key Principles of Halal Investing in the US

If you’re new to halal investing, you might wonder what exactly makes an investment halal. The answer lies in a few clear, faith-based guidelines. These help you avoid not only obvious haram industries but also financial red flags you might not notice at first glance.

Let’s break down the essentials.

Business Must Be Halal

To start, the company itself must be involved in a permissible line of business. No matter how profitable it is, if its core income comes from things like alcohol, gambling, pork, or interest-based finance, it’s not an option.

Even companies that offer mostly halal services can be ruled out if a significant part of their revenue comes from questionable sources.

Financial Ratio Screening (AAOIFI Standard)

Next comes the financial health of the company. A business might sell halal products, but if it’s drowning in interest-based debt, it’s still not compliant.

That’s where the AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) standards come in. These filters help investors assess whether a company is financially clean enough to invest in.

Here’s how those ratios break down:

| Shariah Filter | AAOIFI Limit | Why It Matters |

|---|---|---|

| Interest-Based Debt / Market Value | Less than 33 percent | Avoids companies heavily reliant on loans or bonds |

| Interest-Bearing Securities / Market Value | Less than 33 percent | Limits reliance on earning money from riba-based accounts |

| Impure Non-Halal Income / Total Income | Less than 5 percent | Allows for minor unavoidable exposure but ensures it’s cleaned |

If a company passes these three screens, it’s generally considered halal though purification may still be required.

Purification of Non-Compliant Income

Sometimes, even halal companies earn a small amount from haram sources—say, bank interest or ads on a gambling website. When that happens, you can still invest, but you must purify.

Purification means donating the impure portion to charity. For example, if your dividend was 80 dollars and 3 dollars came from non-halal activities, you’d give away that 3 dollars.

Don’t Forget About Zakat

Yes, even your halal investments are zakatable. If you’re holding stocks or ETFs with the intention of selling them for profit, you’ll likely need to pay 2.5 percent of their current value each year as zakat.

If your goal is long-term growth and you’re not actively trading, the zakat treatment may differ slightly. That’s where tools like NZF USA’s zakat calculator can help.

Step-by-Step Guide to Start Halal Investing in the US

Starting your halal investing journey can feel overwhelming at first. But if you take it step by step, it becomes a lot more manageable. Here’s a clear path to help you begin.

Choose a Halal-Friendly Investment Platform

To begin, you’ll need a place to invest your money. In the US, several platforms now offer halal options:

- Wahed: A Shariah-compliant robo-advisor that builds automated, diversified portfolios. It’s beginner-friendly and backed by a Shariah board

- Aghaz Investments: Designed for goal-based halal investing—great if you’re saving for hajj, college, or retirement

- Amana Mutual Funds: Long-established halal mutual funds, available through traditional brokerages like Fidelity or Schwab

Each of these platforms avoids haram sectors and follows AAOIFI standards, so you can invest with more confidence.

Use a Halal Screening Tool

Before you buy a stock or ETF, check if it’s Shariah-compliant. Even big-name tech companies aren’t automatically halal.

Helpful tools include:

- Zoya App – Screens thousands of US stocks and ETFs, showing you why something is halal or not

- Islamicly – A global stock screening tool with active scholar oversight

- IdealRatings – Used more by institutions, but reliable if you want detailed screening data

Using these tools helps you avoid accidental exposure to haram businesses or finances.

Pick Your Investment Type

Once you have your platform and screening tool, it’s time to choose what to invest in. In halal investing, you have several options:

- Individual Stocks – Many tech and healthcare companies meet Shariah criteria. Think Apple, Nvidia, or Adobe

- Halal ETFs – These are funds that track a whole index of halal stocks. Examples include:

- SPUS: Follows a Shariah-screened version of the S and P 500

- HLAL: Tracks the FTSE USA Shariah Index

- SPTE: Focuses on halal tech companies globally

- Mutual Funds – Funds like Amana Growth or Amana Income pool investor money to buy halal stocks with professional oversight

- Sukuk or Real Estate – For those who want halal income without touching stocks, sukuk or real estate co-ops are valid alternatives

The key is to diversify across asset types while keeping everything halal.

Monitor Compliance Over Time

Just because a company is halal today doesn’t mean it will stay that way. For instance, if a tech company takes on too much debt or buys a haram business, it could fall out of compliance.

That’s why it’s important to check your investments regularly. Apps like Zoya notify you when a stock’s halal status changes.

Understand Zakat and Purification Duties

Many Muslims don’t realize that halal investing in the US comes with extra spiritual responsibilities. Two key areas to keep in mind:

- Zakat: If you’re investing for growth or trading, your holdings may be zakatable. You’ll typically owe 2.5 percent annually on their zakat value

- Purification: If any part of your return comes from haram sources, donate that portion. Tools like Zoya often show how much to purify

By handling zakat and purification properly, you keep your gains both halal and spiritually clean.

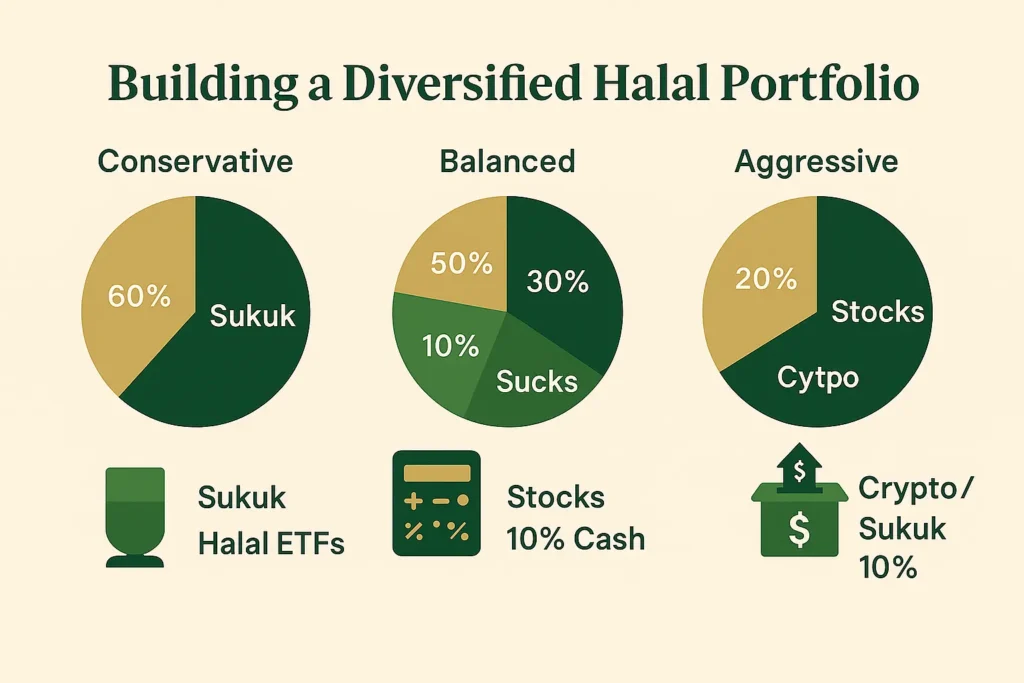

Building a Diversified Halal Portfolio in the US

Once you’ve learned the basics and chosen where to invest, the next step is to build a balanced, diversified portfolio. Diversification simply means spreading your money across different types of halal investments to manage risk and improve your chances of steady growth.

A well-diversified halal portfolio in the US might include stocks, ETFs, mutual funds, and possibly real estate or sukuk.

Here’s how you can approach this based on your risk level:

Conservative Portfolio (Lower Risk)

If you prefer to protect your capital and earn modest returns, this option focuses on stability.

- 50 percent in sukuk or halal fixed-income funds

- 30 percent in broad halal ETFs like SPUS

- 20 percent in real estate investments through halal co-ops or REITs

This mix avoids volatility and leans on steady income sources.

Balanced Portfolio (Medium Risk)

For most investors, a mix of growth and stability works best. You’ll still have downside protection, but also exposure to long-term returns.

- 40 percent in halal ETFs (HLAL, SPTE, SPUS)

- 30 percent in Amana mutual funds

- 20 percent in Shariah-compliant individual stocks

- 10 percent in sukuk or halal real estate

Balanced portfolios are ideal if you’re investing for goals five to ten years away.

Aggressive Portfolio (Higher Growth)

Younger investors or those with long time horizons may be comfortable taking more risk for higher potential returns.

- 50 percent in halal growth stocks (like tech and healthcare)

- 30 percent in halal ETFs

- 20 percent in mutual funds or private halal real estate deals

Keep in mind, higher risk comes with more ups and downs. It’s wise to review and adjust your holdings at least once a year.

Final Tip

No matter your style, always check that each asset remains Shariah-compliant. What was halal last year might not be today. And don’t forget—purification and zakat apply across all asset classes.

Ten Practical Tips for Halal Investing in the US

Even with the right knowledge and tools, investing can still feel intimidating. These tips will help you start with clarity, avoid common pitfalls, and stay aligned with your values.

1. Start Small and Stay Consistent

You don’t need thousands of dollars to begin. Many halal platforms let you start with just $100 or less. What matters most is building the habit.

2. Use Automated Platforms

Robo-advisors like Wahed or Aghaz make it easy to stay diversified and Shariah-compliant without needing to manage every stock yourself.

3. Check Zakat Eligibility Annually

Each year, review which of your holdings are zakatable. If your investments are for trade or growth, they likely qualify. Tools like NZF USA’s calculator can help you do it right.

4. Know Your Risk Tolerance

Before choosing a portfolio, ask yourself how comfortable you are with ups and downs. Halal investing isn’t about avoiding risk—it’s about managing it with intention.

5. Always Read the Fine Print

Before buying into any ETF or mutual fund, look at the fund fact sheet. Make sure it’s Shariah-certified and audited regularly.

6. Understand Dividend Purification

Many halal funds still require you to purify a portion of your dividends. Apps like Zoya often show exactly how much to donate.

7. Pay Attention to Fees

Halal ETFs and robo-advisors tend to have slightly higher expense ratios than conventional ones. Look for value, not just cost, but know what you’re paying for.

8. Reinvest Your Halal Gains

If your portfolio is doing well, consider reinvesting instead of withdrawing. Over time, compounding can turn small returns into real growth.

9. Join Halal Investing Communities

Platforms like Zoya and Wahed offer education, discussion groups, and updates. Learning with others can boost your confidence and discipline.

10. Ask When in Doubt

If something seems questionable—whether it’s a stock, a crypto token, or a real estate deal—consult a qualified Islamic scholar or financial advisor. It’s always better to pause and ask than to guess and regret.

FAQ About Halal Investing in the US

Is it halal to invest in US stocks?

Yes, but not all of them. You can only invest in US stocks that pass both Shariah business and financial screenings. That means avoiding companies involved in haram industries and checking their debt and interest levels. Many tech and healthcare companies meet these standards.

Is investing in the S&P 500 halal?

The standard S and P 500 index includes companies that are not halal. However, the SPUS ETF tracks a Shariah-compliant version of the index. It removes businesses that don’t meet Islamic guidelines, making it a better option for Muslim investors.

Which is the best halal investment?

There’s no one-size-fits-all answer. If you want easy, diversified exposure, halal ETFs like HLAL or SPUS are great choices. For long-term savings, Amana mutual funds are a solid option. If you’re comfortable picking stocks, halal tech companies like Apple or Nvidia might suit you.

Is halal investing legal in the US?

Yes, absolutely. Halal investing is completely legal and protected by freedom of religion and economic choice. In fact, more US-based platforms are now offering Shariah-compliant products because of growing demand.

What is a halal investment app?

A halal investment app helps you find, screen, and manage investments that follow Islamic rules. Popular examples include:

- Zoya – screens stocks and ETFs for Shariah compliance

- Wahed – offers automated, halal investment portfolios

- Islamicly – provides global halal stock data with scholar reviews

These apps make halal investing easier for beginners and experts alike.

Summary: Your Path to Halal Investing in the US

Halal investing in the US is no longer limited to scholars or specialists. Whether you’re a student, a working parent, or planning for retirement, there are now real, accessible tools to grow your money while staying true to Islamic values.

From robo-advisors and mutual funds to ETFs and stock screeners, Muslim investors today can avoid riba, steer clear of haram industries, and purify their income—all while building long-term wealth.

Start where you are. Pick a platform, use a screening tool, and begin with what you can afford. Stick to halal principles, monitor your investments, and remember that intention matters just as much as outcome.

Final Disclaimer

Educational content only—consult a qualified Islamic scholar and licensed financial professional before investing.

Sources

- Wahed – A Guide to Halal Investing in the US

- Saturna Capital – Halal Investing with Amana Mutual Funds

- Islamicly Blog – Shariah-Compliant Stocks in the USA

- SharLife – Top US Halal Stocks in 2025

- Amal Invest – Halal ETF Comparison

- Zoya Blog – SPUS vs HLAL ETF Review

- Zoya Blog – Best Halal ETFs

- Wahed Official Site

- Islamic Finance Singapore – Wahed vs Sarwa

- CryptoUmmah – Shariah-Compliant Robo-Advisors

- NZF USA – Zakat Calculators and Guidance

- IdealRatings – Shariah Compliance Screening Tool