How to Open a Halal Investment Account in the U.S. (Step-by-Step)

Making Your First Halal Investment Simple

Thinking about opening a halal investment account in the U.S.? You’re probably wondering: “Can I invest in stocks? Are ETFs or treasury bonds okay in Islam?” These are smart questions—and really important if you’re a Muslim who wants to grow your money in a way that respects your faith.

The truth is, most regular investment accounts include things that aren’t halal—like interest (riba), gambling, or companies that make money in ways that go against Islamic principles. That’s why it’s important to look for a halal investment account that filters all of that out.

This guide will help you step by step. You’ll learn how to choose a trustworthy platform, avoid the usual beginner mistakes, and keep your investments clean with tools like purification and zakat. It’s all about building your wealth the halal way—with peace of mind.

Why Open a Halal Investment Account in the U.S.?

For Muslims in the U.S., investing means more than just earning profits. It’s also about following Islamic values. These values include avoiding interest and harmful industries.

A halal investment account helps you grow your money ethically. It keeps your wealth away from riba and unethical sectors.

Faith-Aligned Wealth: Your money supports what matters to you.

Clear, Ethical Earnings: These platforms show exactly where your money goes.

Confidence in the Future: You can invest with peace of mind.

You also get access to faith-based investing tools. This growing network helps you stay aligned with your long-term goals. Whether you’re saving for retirement or just starting out, this method brings peace of mind.

Halal investing builds discipline. It also strengthens spiritual and financial awareness. You’re not just investing. You’re investing with purpose.

How to Start a Halal Investment Account in the U.S. (Step-by-Step Guide)

Step 1: Understand What Makes an Account Halal

A halal account only includes companies that meet Islamic guidelines. That means no interest-based debt and no haram income.

AAOIFI is a global Islamic finance standard. It gives clear rules for halal investing. It filters companies using financial ratios and industry types.

When choosing a stock or fund, make sure it follows AAOIFI or similar Sunni standards. This helps protect your faith and your finances.

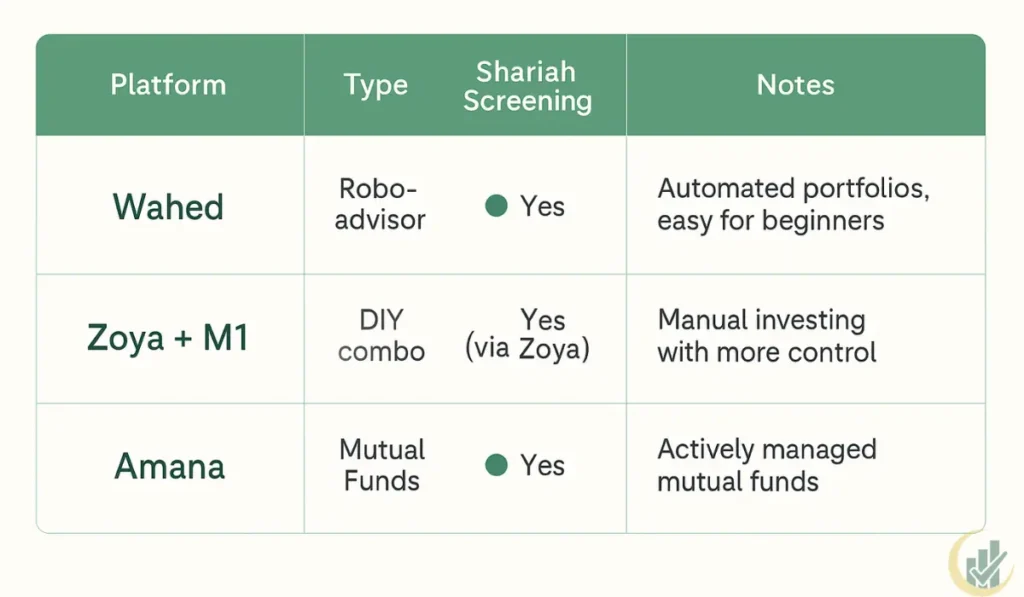

Step 2: Choose the Right Halal Investment Platform

Here are some trusted U.S. platforms for halal investing:

| Platform | Type | Shariah Screening | Notes |

|---|---|---|---|

| Wahed | Robo-advisor | Yes | Automated and beginner-friendly |

| Zoya + M1 | DIY combo | Yes (via Zoya) | Offers more control |

| Amana | Mutual Funds | Yes | Managed funds for long-term goals |

Wahed is good for starters. Zoya helps more active investors. Amana is a solid choice for hands-off investing.

Always check the Shariah board and fees. Low fees and strong screening are key.

Step 3: Fund Your Halal Account

Once you open the account, you’ll need to deposit money. Use a basic checking account. Avoid high-interest savings.

You can set up automatic transfers. That makes it easy to grow your investment slowly.

Even $50 a month adds up. Regular investing builds a strong habit.

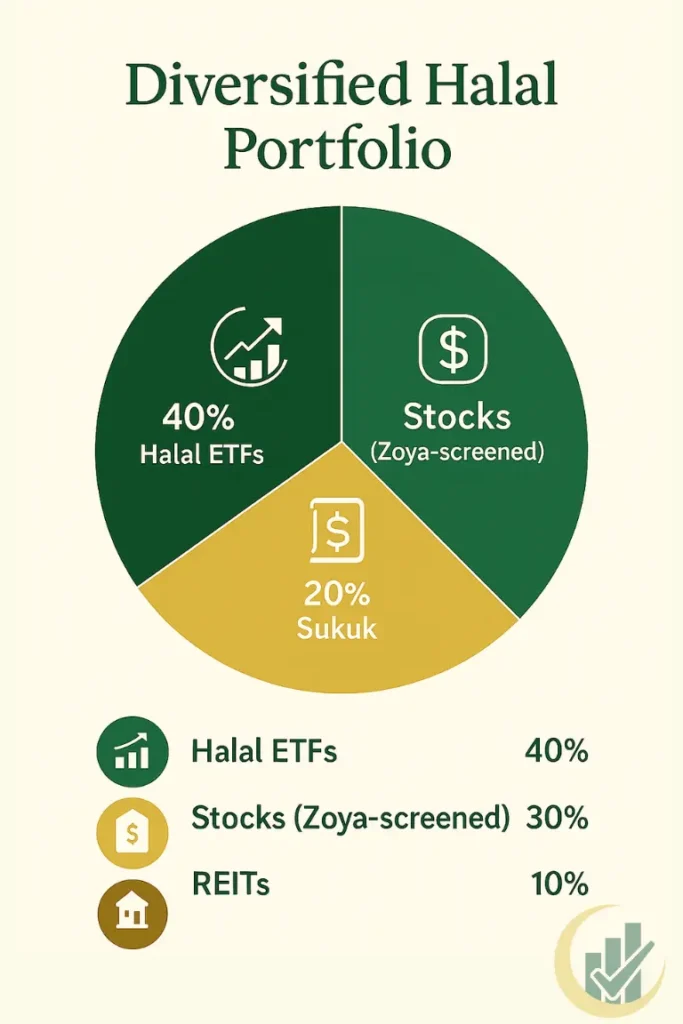

Step 4: Pick Halal-Compliant Investments

Choose only halal investments. These can include:

- Halal ETFs like HLAL, SPUS, or UMMA

- Zoya-screened stocks

- Sukuk funds for fixed income

- Halal real estate (REITs)

Always diversify. Stocks give growth. Sukuk adds safety. ETFs spread your risk.

If you’re unsure, start with ETFs or managed funds. They are simple and already screened.

Step 5: Monitor, Rebalance, and Purify

Every year, check your account. Make sure it stays halal.

- Use Zoya or similar apps

- Remove any impure income

- Donate it to charity

- Calculate zakat (2.5% of your eligible holdings)

Some platforms help automate these tasks. Still, it’s good to double-check each year.

Rebalancing keeps your portfolio healthy. Purification keeps your wealth clean.

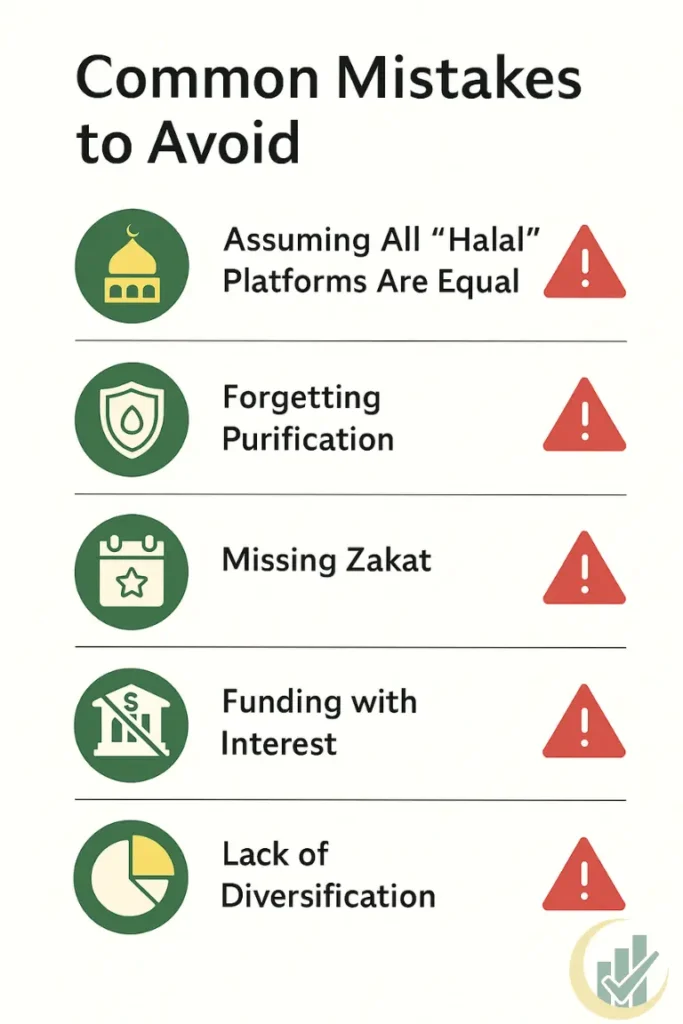

7 Common Mistakes to Avoid

1. Assuming All Platforms Are Equal

Some are stricter than others. Choose one that follows AAOIFI.

2. Skipping Purification

Even halal stocks may earn some impure income. Purify it yearly.

3. Forgetting Zakat

Zakat applies to your investments too. Use NZF USA to help.

4. Using Interest Accounts

Avoid interest. Stick to regular checking.

5. Not Diversifying

Don’t rely on one type of asset. Mix stocks, sukuk, ETFs, and real estate.

6. Skipping Yearly Reviews

Holdings change. Always re-check for compliance.

7. Overlooking Halal IRAs

You can roll over a 401(k) into a halal IRA. It’s smart and Shariah-compliant.

Best Halal Investment Platforms and Funds

Consider these:

- Wahed ETF – Shariah-screened U.S. stocks

- Wahed Invest – Automated halal investing

- Amana Funds – Trusted mutual funds

- Zoya – DIY halal stock screening

- Azzad Fund – Sukuk-focused fixed income

Look for platforms that explain their screening. Transparency builds trust.

FAQ

What’s the best halal investment in the U.S.?

ETFs are good for beginners. Amana is best for hands-off investors. Sukuk offers steady returns.

Are U.S. stocks halal?

Some are. Use Zoya or Islamicly to check.

Is the S&P 500 halal?

No. Try SPUS, a halal alternative.

Are treasury bonds halal?

No. Bonds are interest-based. Choose sukuk instead.

Can I open a halal account for kids?

Yes. Custodial halal accounts are available.

References & Sources

- AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) – Shariah standards

- NZF USA – Zakat calculators: https://www.nzfusa.com

- Zoya Finance – Halal screening tools: https://zoya.finance

- Wahed Invest – Halal robo-advisor: https://wahed.com

- Amana Mutual Funds – Halal mutual fund family: https://www.amanafunds.com

- Azzad Asset Management – Sukuk investments: https://azzad.net

Summary

Halal investing helps you build wealth and stay true to your faith. Choose a trusted platform. Pick halal investments. Purify and pay zakat.

Start small. Stay consistent. Stay halal.

Disclaimer: This article is for informational purposes only. It does not constitute financial or religious advice. Please consult a licensed advisor and qualified Islamic scholar before making investment decisions.