What Is Halal Investing? Discover How to Grow Your Money the Right Way

What Is Halal Investing?

What is halal investing and how do you know if a stock like Tesla is truly compliant? What’s this 5 percent rule people keep mentioning?

If you’ve been asking questions like these, you’re not alone. Many Muslims in the U.S. want to grow their wealth without violating their faith. But figuring out what actually qualifies as halal can feel overwhelming.

That’s why understanding what is halal investing is so important.

In this guide, we’ll explain how halal investing works, what makes an investment permissible, and how to build a Shariah-compliant portfolio from the ground up. From screening rules to zakat and purification, we’ll walk through every step with clarity and confidence.

Why Go Halal With Your Investments?

If you’re a Muslim living in the U.S., you probably get the struggle. You’re trying to build wealth for the future while staying true to your values. Halal investing makes that possible. It’s how you grow your money without compromising your beliefs.

1. Keep Your Money and Morals on the Same Page

Most traditional investments are tied up in areas that conflict with Islamic principles. Think alcohol, gambling, and banks that earn from interest. However, halal investing helps you avoid all that. Therefore, your profits feel right—because they are.

2. No Surprises, No Guilt

A lot of people invest without realizing their money supports things they wouldn’t agree with. That moment of “Wait—I was invested in what?” hits hard. Fortunately, starting with halal investing helps you avoid that. As a result, you invest with peace of mind.

3. You’ve Got Tools Now—Use Them

There are tools to make halal investing easier. For example, platforms like Wahed offer managed portfolios. Apps like Zoya let you screen stocks yourself. Because of this, your decision-making becomes much simpler.

4. It’s Bigger Than Just You

When you invest ethically, you help build a stronger Muslim financial network. You support companies that align with your values. Moreover, you set an example for future generations.

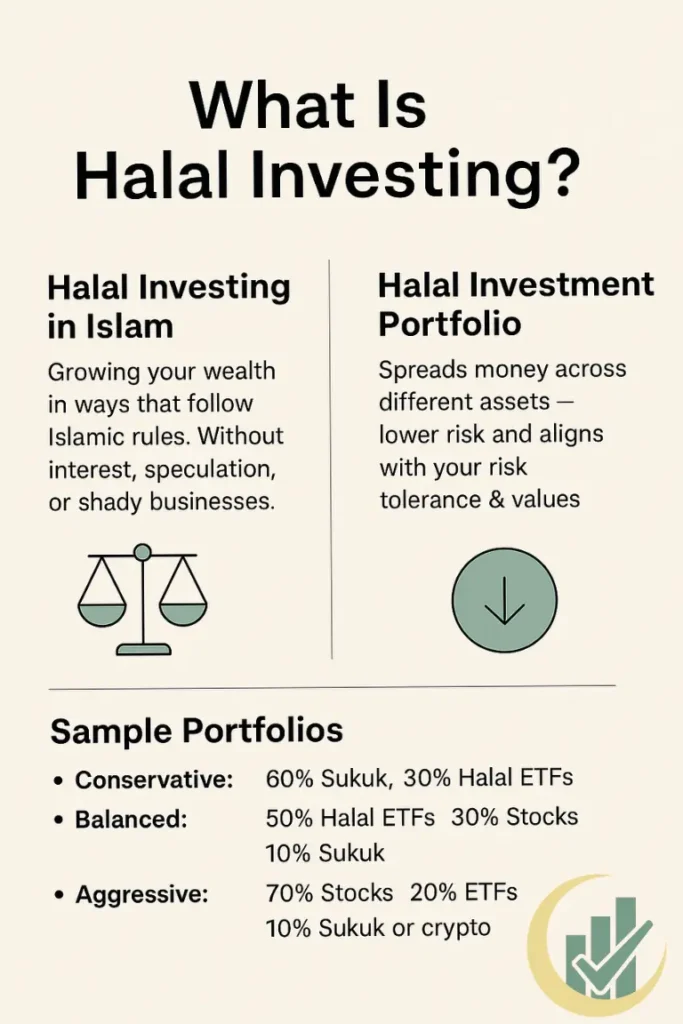

What Is Halal Investing in Islam?

Halal investing means growing your wealth in ways that follow Islamic rules. That means no interest, no speculation, and no shady businesses. The goal is clean money—from clean sources.

It’s not the same as general ethical investing. Instead, halal investing follows defined Shariah guidelines. Groups like AAOIFI set the standards so Muslims can invest confidently.

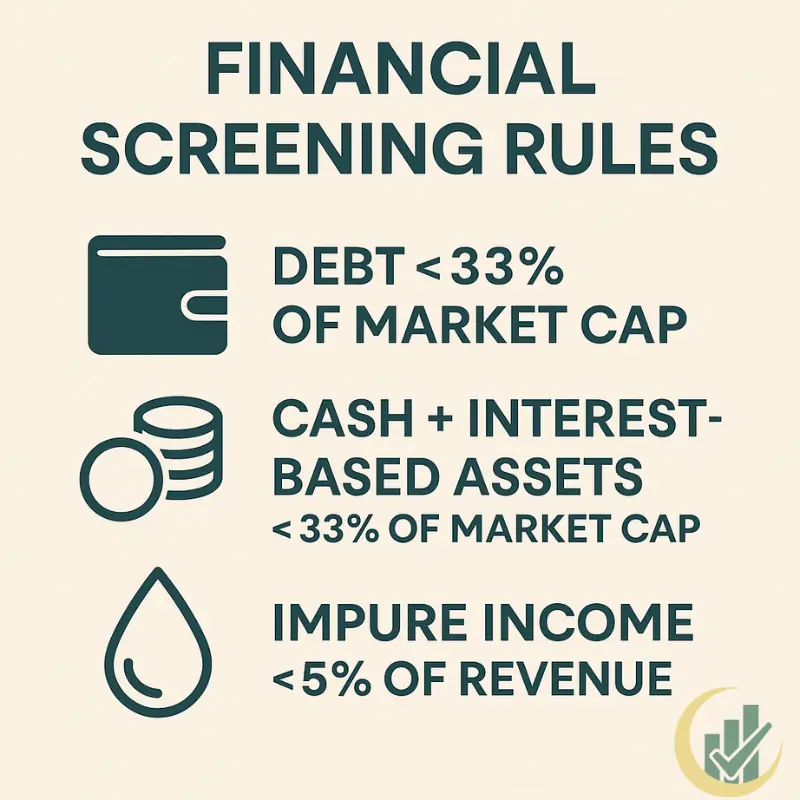

How Does Halal Investment Work?

Halal investment uses clear filters. First, you check the business. If it sells alcohol, pork, or offers loans with interest—it’s out.

Then you check the finances. To be halal:

- Debt must be under 33% of market cap.

- Cash and interest-based assets must be below 33%.

- Impure income (like interest) must be less than 5%.

If a stock passes both checks, it’s good to go. However, if any non-halal income sneaks in, you purify it by donating that amount to charity.

What Is Halal to Invest In?

You have more halal investment choices than you might think. Here are some that qualify:

- Stocks: Choose ones that pass Shariah screens. Use tools like Zoya or Islamicly.

- Halal ETFs: Funds like HLAL, SPUS, and UMMA include pre-screened stocks.

- Sukuk: These are Islamic bonds that don’t involve interest.

- Real Estate: Buying property outright is usually halal. REITs can be too—if screened.

- Crypto: Views vary. Some scholars say certain cryptos are halal if used properly.

What Is a Halal Investing Portfolio?

A halal portfolio spreads your money across different assets. This lowers risk and improves your chance of steady growth. Additionally, it keeps you in line with your risk tolerance and values.

Sample Portfolios

Conservative

- 60% Sukuk

- 30% Halal ETFs

- 10% Cash

Balanced

- 50% Halal ETFs

- 30% Stocks

- 10% Sukuk

- 10% Cash

Aggressive

- 70% Stocks

- 20% ETFs

- 10% Sukuk or certified crypto

Rebalance every year. That keeps you aligned with your goals and Shariah rules. In addition, it helps correct for market shifts and portfolio drift.

What Is Halal Trading and How Does It Work?

Not all trading is halal. These types are not allowed:

- Day trading

- Margin trading (borrowing money)

- Options and futures

- Short selling

Why? Because they involve high risk, speculation, or interest.

Halal trading means buying real, screened assets. You must fully own what you trade. In addition, you can’t borrow money to invest. As a result, your transactions are both compliant and transparent.

Five-Step Guide to Start Halal Investing

Step 1: Avoid What’s Prohibited

Skip businesses linked to gambling, interest, alcohol, and other haram sectors.

Step 2: Choose a Halal Platform

Use Wahed for ease. Or pair Zoya with a broker like M1 Finance if you want more control. Either way, make sure you’re using proper screening tools.

Step 3: Screen Stocks or ETFs

Use halal investing apps like Zoya to check business and financial data. This step ensures you avoid non-compliant holdings.

Step 4: Purify Impure Income

Let’s say you earned $1,000. If 2% is non-compliant:

$1,000 × 2% = $20

Give that to charity. Consequently, your earnings remain clean.

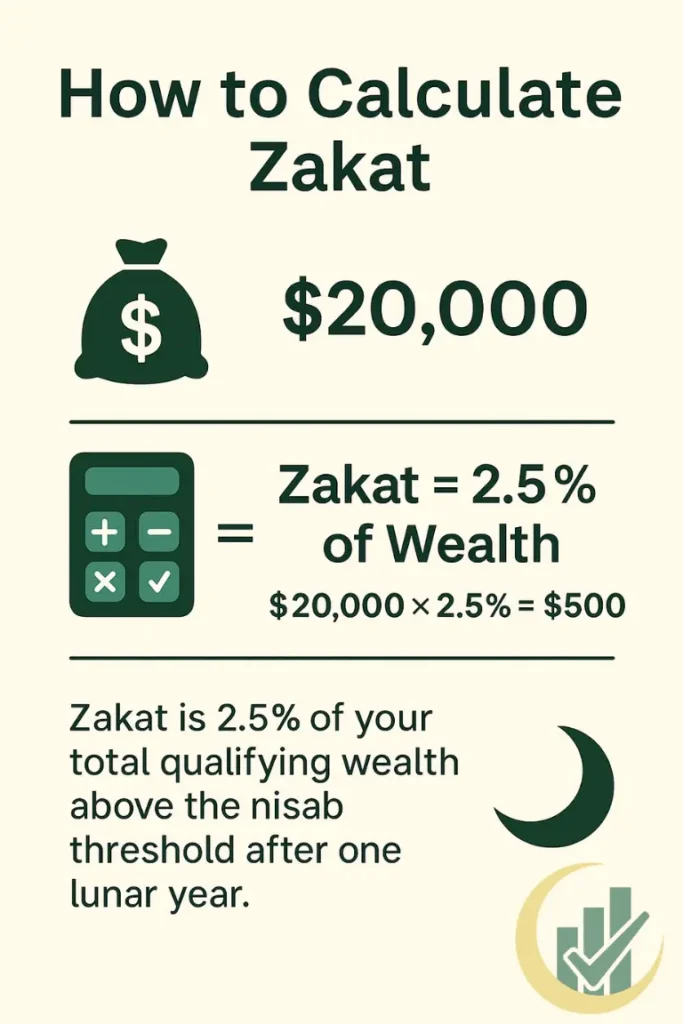

Step 5: Calculate Zakat

Zakat = 2.5% of your portfolio’s value.

Example: $20,000 × 2.5% = $500

Make sure to review your portfolio annually so you stay current.

Ten Practical Tips for New Muslim Investors

- Start with $50 a month if that’s all you have.

- Automate your investing.

- Never borrow money to invest.

- Use stock screeners often.

- Spread your money across sectors.

- Check your ETF holdings yearly.

- Learn how to purify.

- Set a zakat reminder.

- Join a Muslim investing group.

- Ask both a scholar and a financial planner.

FAQ

What is meant by a halal investment?

It’s one that avoids interest, unethical sectors, and gambling. It should be fair, transparent, and asset-backed.

How do you know if an investing is halal?

Screen it using apps like Zoya or Islamicly. Check the company’s industry and financial ratios.

Is Tesla investing halal?

Sometimes yes, sometimes no. Use a screening tool to check. Then purify any impure income.

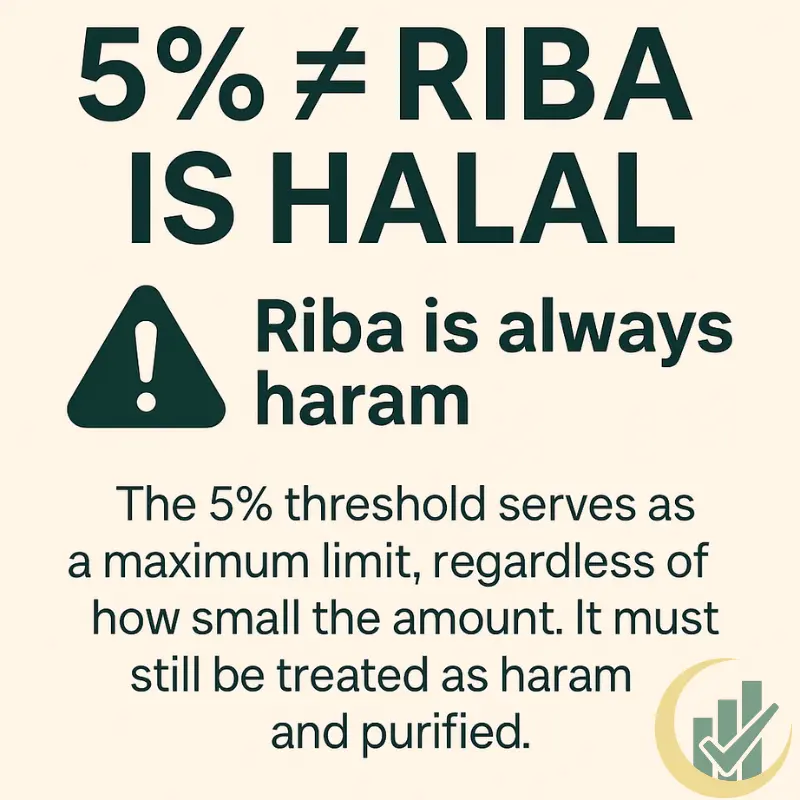

What is the 5 percent rule in halal investing?

Some scholars allow investing in a company if its impure income—like interest—is less than 5% of total revenue. But this does not mean riba is halal. That 5% is just a tolerance limit, not permission. If you choose to invest in such companies, you must purify your earnings by giving the impure part to charity. This is not optional—it’s an obligation to stay Shariah-compliant.

Summary

Now you know what halal investing is and how it works. It’s not about avoiding wealth—it’s about earning it cleanly.

With the right tools and understanding, you can build a portfolio that supports your values. Use this guide as your roadmap.

Want to go deeper? Read our Zoya vs. Wahed comparison and see how to calculate zakat on stocks.

Educational content only—consult a qualified Islamic scholar and licensed financial professional before investing.

If you invest in such companies, you are obligated to purify your earnings by giving away the impure portion to charity. This is not optional—it is required to remain Shariah-compliant.

🔗 Source:

- AAOIFI Shari’ah Standard No. 21 – Financial Papers (PDF, English)

- Dividend Purification Process – IJM, UNISHAMS 2019 (PDF)

⚠️ Disclaimer

This article provides general educational information. It references common Shariah screening guidelines, such as the 5% tolerance rule, as applied by scholars and platforms. Riba remains strictly prohibited in Islam. The 5% rule does not justify interest, but is a form of ijtihad used by some scholars to manage limited exposure. Always consult a qualified Islamic scholar and licensed financial advisor before making investment decisions.

Disclaimer: This article is for informational purposes only. It does not constitute financial or religious advice. Please consult a licensed advisor and qualified Islamic scholar before making investment decisions.