Zakat on Stocks and ETFs: How to Calculate and Purify

A practical guide to calculating zakat on stocks, ETFs, and retirement accounts using halal financial tools.

Understanding Zakat on Stocks

If you own stocks, you might wonder: Do I need to pay zakat on my portfolio? You’re not alone. Many Muslims in the U.S. want to invest in a halal way. However, they aren’t sure how zakat applies to stocks. It’s more complex than writing a check once a year.

Zakat is a spiritual obligation. But applying it to modern financial tools; like brokerage accounts, ETFs, and dividends, can feel overwhelming. Should you pay based on purchase price or market value? What about stocks in a retirement account?

Thankfully, there are answers. With the right tools and clear guidance, calculating zakat on stocks becomes manageable and spiritually uplifting. This article explains when zakat is due, how to classify your stocks, and how to calculate and purify your investments. All advice follows Sunni fiqh and standards from trusted sources like AAOIFI and NZF.

Why You Need to Pay Zakat on Stocks

Zakat is the third pillar of Islam. It’s a spiritual duty that shows gratitude for wealth and helps support those in need. According to classical Islamic law and modern Islamic finance experts like AAOIFI, zakat applies to business and investment assets.

Stocks represent ownership in a company. Companies usually hold zakatable assets like cash, receivables, and inventory. So, owning shares gives you a portion of those assets. That portion is zakatable.

You must pay zakat on stocks if:

- You are a Muslim adult of sound mind

- You’ve owned the stocks for one lunar year (hawl)

- The total value of your zakatable assets exceeds the nisab

Nisab is the minimum wealth required before zakat becomes obligatory. It equals 87.48 grams of gold or 612.36 grams of silver. As of June 2025, the gold nisab is around $5,400. Always check an updated source like NZF USA for current nisab values.

Zakat is more than a duty—it purifies your earnings and protects your heart from greed. Giving zakat on stocks helps you fulfill your faith while uplifting others.

When Is Zakat Due on Stocks?

Zakat is due after one lunar year passes over your wealth. To determine when to pay:

- Choose a consistent date on the Islamic calendar (Ramadan 1st is common)

- Review the value of all your zakatable assets on that date

- If your total value exceeds the nisab, zakat is due

You must use the current market price of your stocks on that zakat date—not the original purchase price.

Example:

- You bought stocks for $3,000 in 2023

- By Ramadan 2025, they are worth $6,500

- You must pay zakat on $6,500

Even if the stock’s value dipped during the year, as long as it’s above the nisab on the zakat date, you owe zakat.

How to Calculate Zakat on Stocks

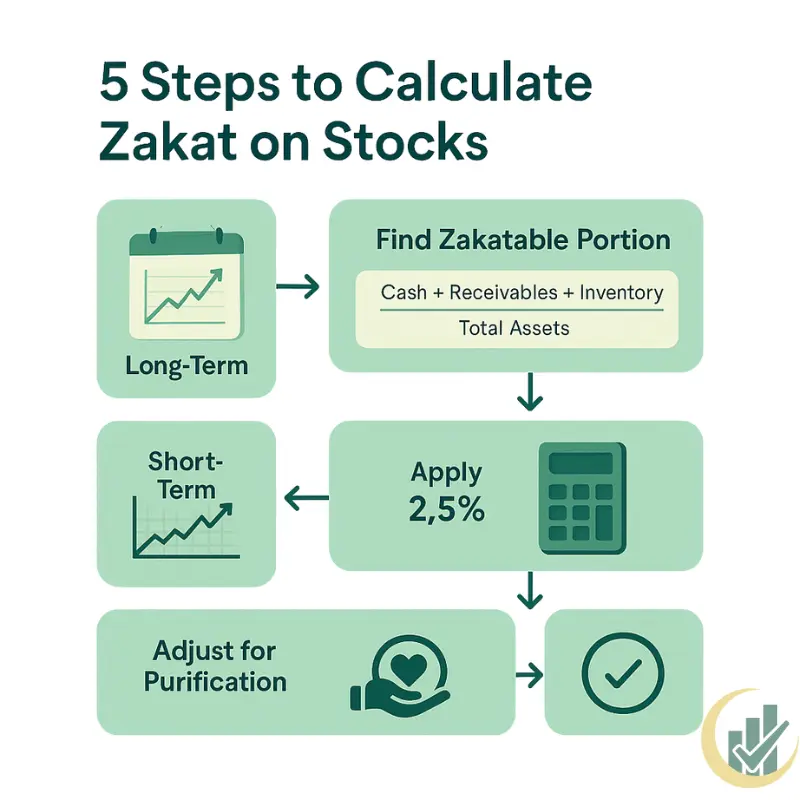

How you calculate zakat depends on your reason for owning the stocks. Sunni scholars classify stock ownership into two categories:

Step 1 – Classify Your Stocks

1. Stocks Held for Trade (Short-Term)

These are bought to sell at a profit, like business inventory. If you trade stocks often, you pay zakat on the entire market value.

2. Stocks Held for Investment (Long-Term)

These are kept for dividends or long-term growth. You only pay zakat on the zakatable portion of the company’s assets—cash, receivables, and inventory.

Tip: If your intention changes (e.g., from long-term to short-term), update how you classify the stock.

Step 2 – Find Net Zakatable Value

For long-term stocks, estimate the zakatable portion using this formula: Zakatable %=Cash+Receivables+InventoryTotal AssetsZakatable\ \% = \frac{Cash + Receivables + Inventory}{Total\ Assets}

Example:

- Cash = $500M

- Receivables = $300M

- Inventory = $200M

- Total Assets = $2B

Zakatable %=500+300+2002000=50%Zakatable\ \% = \frac{500 + 300 + 200}{2000} = 50\%

Multiply your total investment by this ratio to find the zakatable base.

Step 3 – Use 2.5% Formula for Zakat on Stocks

Now apply the zakat rate: Zakat = Zakatable Base × 2.5%Zakat\ =\ Zakatable\ Base\ \times\ 2.5\%

Example: If you own $5,000 in stock with a 50% zakatable portion: Zakat=5,000×50%×2.5%=$62.50Zakat = 5,000 \times 50\% \times 2.5\% = \$62.50

Step 4 – Adjust for Purification if Needed

Even halal stocks may earn minor income from haram sources, like interest. You must purify that amount by donating it.

Steps:

- Use a screening tool (Zoya, IdealRatings, or Wahed)

- Find the haram income percentage

- Multiply it by your stock value

- Donate that amount to charity

Example:

- Portfolio: $10,000

- Haram income: 2%

Purification=10,000×2%=$200Purification = 10,000 \times 2\% = \$200

Step 5 – Example: Zakat on $10,000 Portfolio

You hold $10,000 in long-term stocks.

- Zakatable portion = 50%

- Haram income = 2%

Zakat: 10,000×50%×2.5%=$12510,000 \times 50\% \times 2.5\% = \$125

Purification: 10,000×2%=$20010,000 \times 2\% = \$200

Tools to Help You Calculate Zakat on Stocks

These tools make your calculations easier:

- Zoya – Screens stocks and provides zakatable/purification data

- NZF USA Calculator – Covers stocks, crypto, and retirement accounts

- Wahed Invest – Built-in zakat tool for clients

Using these platforms reduces confusion and helps you follow trusted Sunni guidelines.

Zakat on ETFs, Mutual Funds, and Retirement Accounts

Muslim investors often hold stocks through funds or retirement accounts. Here’s how zakat works:

ETFs (e.g., HLAL, SPUS, UMMA):

- Use zakatable ratio if available

- If not, estimate 30–50%

Zakat=Value×Ratio×2.5%Zakat = Value \times Ratio \times 2.5\%

Mutual Funds:

- Treat like ETFs

- Estimate zakatable portion if data is missing

Retirement Accounts (401k, IRA):

- Zakat is due if funds are accessible (even with penalty)

- Subtract 30% for tax/penalty, then calculate zakat

Example:

- Balance: $60,000

- After tax: $42,000

- Ratio: 40%

Zakat=42,000×40%×2.5%=$420Zakat = 42,000 \times 40\% \times 2.5\% = \$420

FAQ

Do you have to pay zakat on stocks?

Yes. If held for one lunar year and above nisab, stocks are zakatable.

What is the zakat rate on stocks?

2.5% of the zakatable amount.

How do I calculate zakat on ETFs?

Use provider data or estimate zakatable ratio.

Is zakat due on retirement accounts?

Yes, if funds are accessible. Subtract taxes and apply zakatable ratio.

How can I check if a stock is halal?

Use halal screening tools like Zoya, Wahed, or IdealRatings.

Summary

Paying zakat on stocks is part of purifying your wealth. Whether you invest through ETFs, brokerage accounts, or IRAs, the steps are clear:

- Choose your zakat date

- Classify each stock

- Calculate the zakatable value

- Apply the 2.5% rate

- Purify any haram income

Zakat is a gift—it cleanses wealth and uplifts the Ummah. Tools like Zoya, NZF, and Wahed help make it easier.

Final Disclaimer

This content is educational. Please consult a qualified Islamic scholar and a licensed financial advisor for personal zakat and investment guidance.

References & Sources

- AAOIFI Shari’ah Standard No. 35 (Zakah)

- NZF USA: https://www.nzfusa.com

- Mufti Faraz Adam, Amanah Advisors

- Zoya Finance & Purification Guide: https://zoya.finance

- Wahed Invest: https://wahed.com